In the iconic 1987 thriller “Wall Street,” Lord of the Universe Gordon Gekko tasked his devotees with unearthing the smallest nuggets of corporate information that might foretell future stock market price movements.

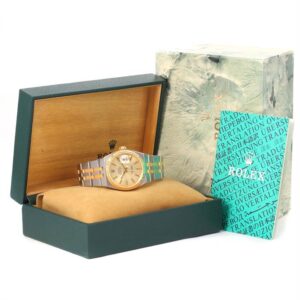

More recently, as replica watches on the waiting lists of Rolex, Audemars Piguet and Patek Philippe have been traded like stocks, a new legion of speculators is similarly reading the runes for clues to market direction.

We can all see the “exhibition only” signs in jewellers’ windows, which does not mean that these watches are completely unavailable, only that they are being channelled directly from the safes of authorized dealers into the hands of their most loyal, most consuming customers.

Suppose we know that waiting lists are getting shorter and fake watches are being delivered months rather than years after deposits are paid. In that case, this is a sure indication that supply is improving, which should put downward pressure on demand and prices in the secondary market, as there is no incentive to pay significant premiums on the secondary market when the waiting list may only be a few months.

Subdial gathers information from major secondary market sites, Chrono24, Watchfinder, Mrwatchmaster and others, to track prices and inventory, tracking the most traded watches with its extremely useful Subdial 50.

In a previous column, I shared charts showing how prices for some of the hottest watches spiked between last summer and this spring and then fell dramatically over the past few months.

Why? Because after supply on the pre-owned market spiked in March, major watches, particularly discontinued models from the replica Rolex Oyster Perpetual, Audemars Piguet Royal Oak and Patek Philippe Nautilus collections, have fallen sharply.

This chart shows a sharp rise in supply as speculators sensed or engineered a market top in March and cashed out at the moment of maximum profit.

Another way to look at it is that people may have withdrawn their watches, hoping that another opportunity would present itself because they missed the peak. Royal Oak availability doubled year-over-year, while Nautilus and Oyster Perpetual inventories increased by 54% and 34%, respectively.

Those clone watches still in production, even those with long waiting lists at authorized dealers, also saw an increase in inventory on the secondary market, but at a much lower percentage, reflected in more modest price increases and decreases.